Tackling huge problems and questioning received wisdom inevitably evokes creative tension. Part of the magic of the Toniic community is the way that tension is held. Tension between conviction and curiosity. Between market rate and flexible capitalists. Differing views on which is the root problem the solution to which unlocks the others.

What distinguishes Toniic culture is the personal respect with which these differing perspectives are explored, the courageous conversations enabled by an extraordinary level of trust, and the palpable warmth of the community to newcomers.

This spirit of open-mindedness also informs our overall approach to impact investing. The industry is too young and small (as a percentage of global capital) to be siloed. So we pitch a big tent that welcomes asset owners who share our broad vision for a world in which all investments honor the planet and its inhabitants.

The Toniic approach to impact investing reflects this spirit. Check us out and see for yourself.

Adam Bendell

Toniic CEO

What is Impact Investing?

Impact investments are investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return. Our partner the Global Impact Investing Network (The GIIN) has defined four “core characteristics” of impact investing:

- Intentionality,

- The use of evidence and impact data in investment design,

- The commitment to manage impact performance, and

- The commitment to contribute to the growth of the industry.

ESG investors are typically concerned with environmental, social and governance risks and opportunities that may have “financial materiality”: those risks and opportunities that may affect the financial performance of the enterprise in the medium term.

Impact investors go further – they invest where either the underlying product or service, or their capital or engagement, seeks to contribute to solutions to one or more big world problems.

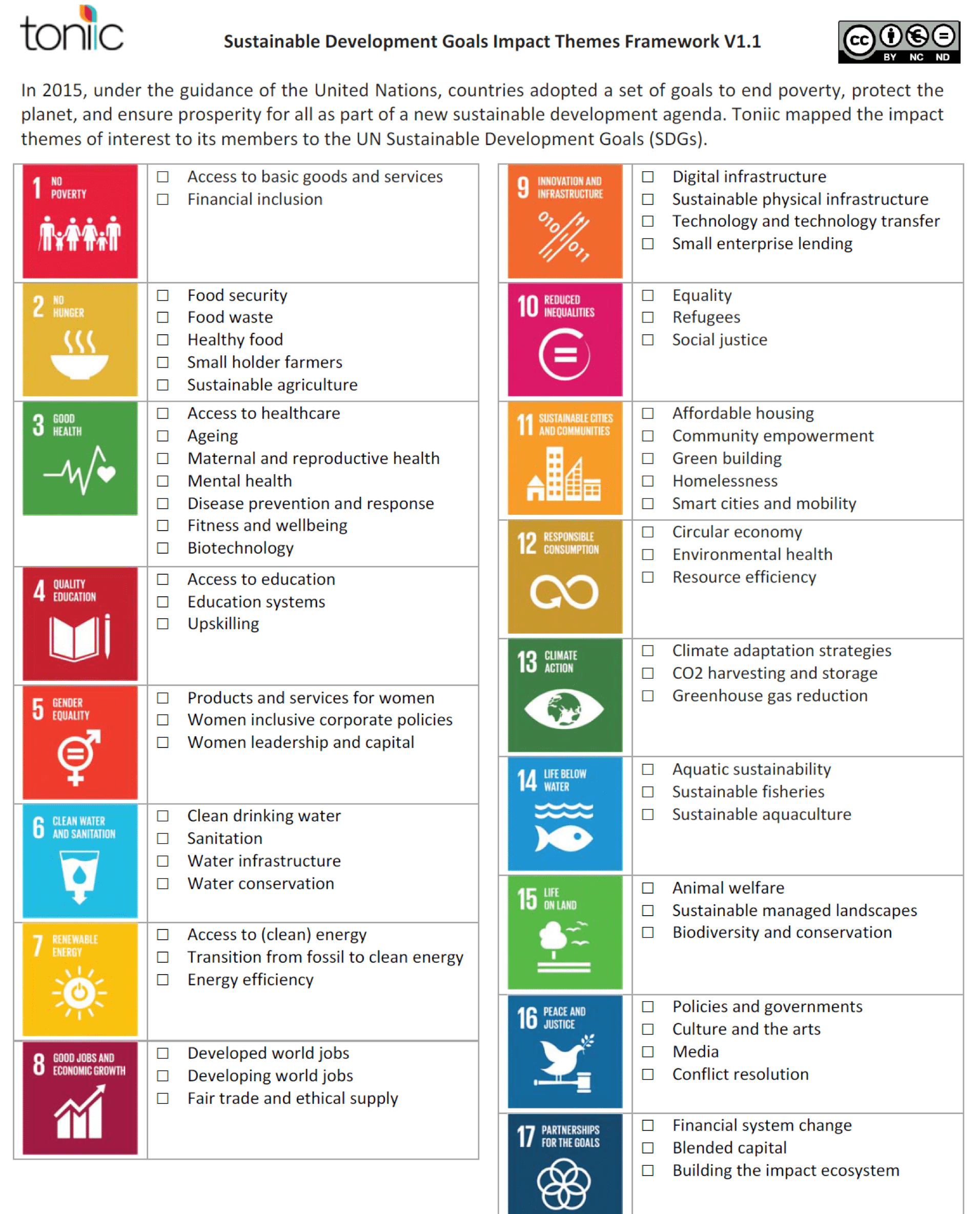

Most of these problems are summarized in the UN Sustainable Development Goals (the SDGs). Impact investors seek to contribute to solving these problems as additional considerations beyond the financial materiality concerns of ESG investors.

Investors around the world (along with governments, NGOs, corporate actors and many others) have aligned around the 17 SDGs as a shared framework for tackling big world problems. We at Toniic use the SDGs as one of the ways to understand and manage the impact of our portfolios.

The Toniic Approach to Impact Investing

Toniic needed a more granular taxonomy tied to the SDGs to match members with others working in the same impact themes, and to match members with investment opportunities. So in 2016 we co-created with our members the Toniic SDG Impact Theme Matrix, 60 themes tied to the SDGs and their targets. We and others in the field use this comprehensive and aligned framework throughout our work.

You can download a PDF of the framework in full:

Toniic is a global community of active impact investors. We envision a world in which all investments honor the planet and its inhabitants. Our mission is to catalyze deeper positive net impact across the spectrum of capital. What does all that mean?

“Net impact” is a recognition that all investments have both positive and negative impacts. We seek to invest where there is a shared intention to mitigate the negative impacts and accentuate the positive ones, and to take responsibility for all the effects of an enterprise, not just the ones reflected on traditional financial statements.

Classical economics describes as “externalities” important social and environmental effects that don’t hit the enterprise financial statements. Since these effects aren’t directly felt in the financial performance of the enterprise, they have classically been ignored. That intentional ignorance has led to a raft of huge social and environmental problems, like poverty, environmental degradation, climate change, gender disparities, food insecurity and unequal access to health care. Impact investors reject the idea that externalities should be ignored in investment decisions. What is externalized from an enterprise is borne by the commons. We invest with care for the whole world, not just ourselves.

“Deeper” refers to the recognition that even impact investments vary in the depth of their positive impact. Our goal is to continually deepen our positive net impact across our portfolios.

Speaking of portfolios, Toniic has been a leader in advocating for the portfolio approach to impact investing. When the term “impact investing” was coined more than a decade ago, it was understood most narrowly to mean early stage private equity investments in social entrepreneurs. That understanding has changed. Most now agree with us that, since all investments have impact, we can use impact investing as a lens across an entire portfolio, in every asset class.

Toniic members have strategies for seeking positive net impact in every asset class. Some have declared a “100% activation” commitment – that a portfolio be transformed over time such that every investment is made with an impact lens. Others have not made a 100% commitment but are nevertheless working across multiple asset classes. And still others devote a portion of the portfolio to impact investing and manage the remainder traditionally. All of these approaches are welcome at Toniic. We are a diverse community and seek to support one another regardless of differences in our values or approach.

The “Spectrum of Capital” refers to the range of return expectations different investors have. Institutional investors (particularly those managing other people’s money) typically consider themselves constrained to “market rate” investments. The market rate is set by investments in which externalities are not taken into account, but are instead imposed on the commons.

Private investors of the type that Toniic represents (high net wealth individuals, family offices and foundations) are typically more flexible and nuanced in their return expectations for each asset class. Within Toniic member portfolios you will find investments across the spectrum of capital. Some seek only market rate returns, on the theory that there are ample investment opportunities for which there is no tradeoff between impact and financial return, and that demonstrating the success of such investments is the best way to inspire traditional investors towards positive impact. Others take an “appropriate returns” approach. They seek “appropriate return” for the impact they simultaneously seek. They recognize that there are some investments that can create tremendous positive impact, create a self-sustaining business model that reduces or eliminates the need for ongoing philanthropic support, and generate a reasonable financial return for the investor – but not market rate. Most Toniic investors work across the spectrum of capital, viewing impact as an additional constraint in portfolio construction, not a binary tradeoff.

What about early stage impact investing?

While Toniic embraces a portfolio approach, we continue to emphasize the importance of early-stage investments, particularly in difficult markets. Such investments are a source of great joy for the investors who make them, as they provide the clearest connection to our intention of contributing to solutions to the big world problems. And they provide capital to those who have traditionally lacked access – such as entrepreneurs in the developing world who are closest to the problems they seek to address.

What about philanthropy?

Toniic is pro-philanthropy! While our core mission is to support impact investing, virtually all Toniic members are also philanthropic grantors or donors. We recognize that some problems are not investable, or that philanthropy can complement investing in various ways. Blended capital structures (that include below market or philanthropic tranches of capital) are often uniquely suited to addressing particular problems.

Alternative Structures

Just as we inherited the idea of externalities, we inherited the investment structures of traditional investing. The classic private equity and venture capital fund structure — with a ten year term and a portfolio of investments constructed on the assumption that most investments will fail and one or two will make up the bulk of the financial returns – is ill-suited to many early stage impact investments. There are many innovative alternatives, such as self-liquidating investments and alternative exit vehicles, that allow an investor to be repaid while preserving the mission and not requiring a traditional “exit.” Toniic’s Impact Terms Platform highlights many of these innovations.

Measuring Enterprise Impact

The field of impact measurement in philanthropy is well-established, but impact measurement in investing is still young. There are disagreements not only about the best methods, but also whether the goal should be a single quantitative score that encompasses all negative and positive impacts.

What has been agreed, with the leadership of our partner the Impact Management Project, is that the impact goals or performance of a business can be summarized as falling within in one of four classes:

- Does (or May) Cause Harm –enterprises that don’t take their impact into account.

- Act to Avoid Harm – The enterprise prevents or reduces significant effects on important negative outcomes for people and planet

- Benefit Stakeholders. The enterprise not only acts to avoid harm, but also generates various effects on positive outcomes for people and the planet

- Contribute to Solutions The enterprise not only acts to avoid harm, but also generates one or more significant effect(s) on positive outcomes for otherwise underserved people and the planet.

Investor Contribution

In addition to enterprise contribution, investors can contribute to impact. The IMP describes the ways they can do so as various combinations of signaling that impact matters, engaging actively, growing new and undersupplied capital markets, and providing flexible capital.

At Toniic, we talk about investor intentionality more simply:

values alignment and impact contribution

Values alignment is a critical step in “detoxifying” a portfolio. Impact investors vary in their assessment of the potential for impact (particularly “additionality”) in public equities, but do typically agree that one’s publicly traded investments can be values aligned. Given the liquidity and market-tested pricing advantages of public investments, they play an important role in most diversified portfolios.

Impact contribution goes further than (the very important step of) values alignment. It seeks to use capital and other investor resources like time, talent and networks, to engage for change or deploy capital where traditionalists won’t.

Two Dimensions

Putting it together, we see that there are two dimensions to any impact investment: That the underlying businesses in which we invest contribute to solutions to big world problems, and that the intention of the investor for positive change be expressed by or with the investment.

We at Toniic have made the two dimensions of this framework — what the Impact Management Project calls the “Impact Class Matrix” — our primary lens for categorizing impact.

We have added a row and a column to the usual presentation of this matrix by the IMP in order to account for the many investments in the typical portfolio that may or do cause harm (traditional investments that have no concerns for “externalized” impacts), and for those investments in a portfolio that are “legacy” or have not yet been evaluated for impact from an investor contribution perspective.

Our “remix” of the IMP Investor Class Matrix simply adds those logical possibilities in positioning investments within the IMP Impact Class framework, and does not change any definitions or its intended use.