$1.164 Trillion is the estimated size of assets under management (AUM) from 3,349 asset managers in the impact investing market in 2022, according to a study from our friends at the Global Impact Investing Network (GIIN).

Fairfield Market Research even anticipates the Global impact investing market size to hit the US$4.5 trillion mark by the end of 2030.This is an impressive growth for a market which was considered an “emerging asset class” in 2010, with an estimated $2.4B invested across geographies, instruments and impact themes (according to this Research from JPMorgan, Rockefeller Foundation and the GIIN). Private Equity (including venture capital, growth and buyout) made up $836M of the $2.4B in 2010, which would make it a drop in the ocean of current capital being deployed.

Ananda Impact Ventures

Ananda Impact Ventures is one of the pioneer Impact investment firms in Europe, deploying venture capital since 2010. Now managing over €200M across four core impact funds, including its current €108M, SDFR Article 9 fund, backed by the European Investment Fund (EIF), the German State Development Bank KfW Capital, Investcorp Tages. Multiple Toniic members are also investors in Ananda across Fund I, II, III and IV.

The firm has a portfolio of 35 companies spread across DACH, the UK, Benelux and the Nordic countries.

First European Impact VC Firm to Prove That Impact Investing Can Be Profitable

In 2010, Ananda raised over €7M for their Social Venture Fund I (SVF 1). The first recently announced that they successfully fully realized its Social Venture Fund I, returning a 2x money-on-invested-capital (MOIC) and thus becoming the first European Impact VC firm to prove that Impact Investing can be profitable.

Social Venture Fund I (SVF I)

Social Venture Fund I made 5 investments and had 4 exits. All investments had positive impact returns.The fund provided crucial backing for its startups tackling some of the world’s most critical issues, from education to employment, gender equality to reducing poverty. 2,033 jobs were created by portfolio companies.

Portfolio Examples

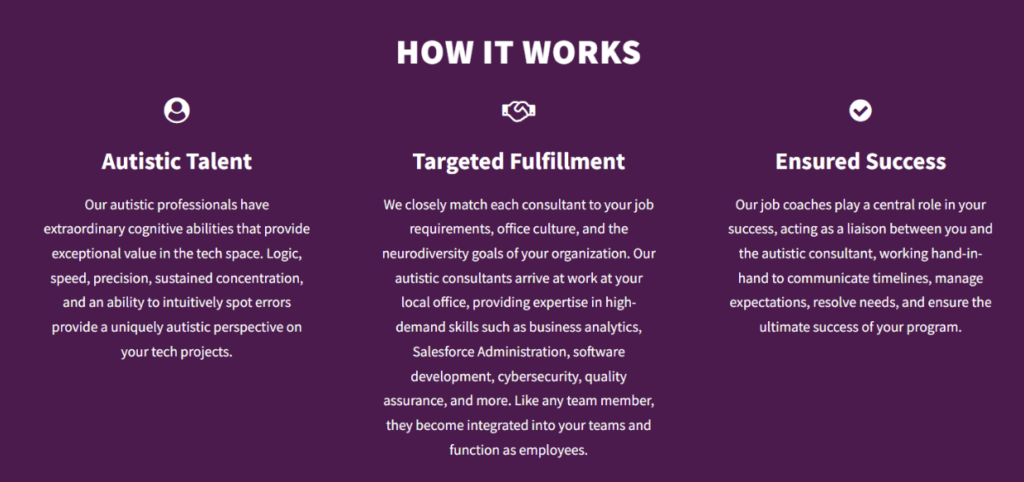

Auticon, is a global technology employer which exclusively employs adults on the autism spectrum as IT consultants. Clients include Deloitte, Disney, Salesforce, Allianz, IBM and KPMG.

In 2023, Auticon had 465 employees on the autism spectrum in 9 countries. About 70% were not employed prior to joining auticon and 90% report an improved quality of life since joining the company.

In June 2023, Auticon merged with Unicus to form the largest autistic-majority company in the world.

Ananda Impact Ventures and Toniic

Johannes Weber, Ananda Founding Partner has been a valued member of the Toniic community for over 6 years contributing both as an asset owner and asset manager.

Toniic has been absolutely instrumental on my path as an impact investor and 100%er. Through this remarkable community, I have made friends that provided me with guidance and support throughout my journey. For our impact fund, Toniic has been a great platform for sharing investment opportunities and a valuable hub for knowledge exchange among like-minded investors.

Johannes Weber

Some investors of the Toniic community have invested in some of Ananda’s funds prior to joining Toniic, others have invested thanks to Toniic’s fund program.

Stephen Brenninkmeijer and James Perry are two Toniic members who are investors in Ananda’s SVF I and very satisfied with their investment:

Ananda has been changing the face of Impact Investing one successful fund at a time for over twelve years, during which time I’ve been proud to be partnered with them on their ever-changing and always impressive journey.

Stephen Brenninkmeijer

From 2010 we were searching for credible investors seeking to create an Impact Venture Capital firm. There were very few around, and we invested in Ananda’s first fund because the founders were some of the very first that we found. The combination of professional venture capital discipline with total focus on delivering impact as the purpose was, at the time, almost unique in Europe. It was clear to us that the firm was serious about maximising positive impact, and we believed that the individuals behind it would ensure that they would deliver sufficient financial returns to succeed, and grow their firm. With Ananda, we are delighted to have been correct on both fronts – which is not necessarily the case with all of our impact investment decisions. We have been able to follow on with investments into subsequent Ananda funds and are delighted to have been a tiny part of their story, as they have been a true pioneer, helping to blaze the trail to demonstrate that there is a better way to think about venture investing

James Perry, Snowball

Toniic’s fund program

Toniic runs a fund program enabling fund managers to share details of their capital raises with the 500+ investors of the Toniic community. A large number of funds are sourced from within the Toniic community, as existing investors who are members of Toniic are often keen to share impact opportunities with their Toniic members.

Four Toniic members were previous investors in Untapped Impact Notes, including Sayuri Sharper who made the introduction to the Untapped team.

“I’ve been an investor of Untapped since the inception of the fund, and am very satisfied with both its impact and financial return. Untapped is the first fund that I am aware of that uses a revenue share model for asset backed financing to facilitate scaling of African businesses. What impresses me most about Untapped is its commitment to total transparency. Investors can track performance of each of Untapped loans and resulting impact through the investor portal and have full visibility to its operation”

Sayuri Sharper:

Toniic member Ed Brakeman also said:

“Untapped is meeting an important need in providing funding for African SMEs that are seeking growth capital to support capital expenditures in productive assets. Untapped is approaching this in a unique way that is well-aligned with their partners objectives.

Through Toniic’s fund program, which includes onboarding the fund on our global platform, an investor matching service, an internal investor call and some group investor calls, Toniic member Donald Dolifka was able to learn about the opportunity, ask questions.

Donald is the latest Toniic member to commit to Untapped.

Donald Dolifka:

Untapped Global has created a unique lending program to help address the massive SME funding gap in Africa. The company combines cutting-edge digital technology along with strong field building systems to properly source and de-risk asset-backed financing programs. Their unique revenue sharing structure provides debt repayment stability for the borrower while delivering market rate returns to investors. I’m particularly impressed with Jim Chu’s mission to empower small business in Africa, while utilizing his experience and leadership to build the supporting technology and people systems.

About Toniic:

Toniic is a global community of private asset owners seeking to steward wealth and use influence to enable a thriving world. Our members – more than 500 high net-wealth individuals, family offices and foundations from more than 25 countries – are active impact investors and philanthropists, for whom Toniic provides education, investment opportunities, impact support, events, and community. Toniic also seeks to build the field of deep impact investing, moving money and mindsets and leading by example.

Click here to learn more about Toniic.

Or contact Julien Gafarou, Director of Investment Research if you’d like to learn more about the Toniic membership or to share an investment opportunity