Despite some small gains across categories like education, employment, and wage growth – the needs of working women continue to be under-estimated, under-innovated and under-invested.

While the gender pay gap is narrowing, as of Q3 2023, women’s earnings in the US are still 17% lower than men’s, as per data from the Bureau of Labor Statistics. And while professional responsibilities have increased, women continue to be the primary caregivers in their families, looking after children and/or parents. Some even have to slow down their career progressions or cut back on paid work to take on unpaid-care work. A BGC analysis estimates the value of unpaid-care labor to be $2.5T to $3.5T a year in the US.

Springbank is a venture firm investing in the infrastructure to improve the lived experience of women and help close the gender gap. The firm was created with the view that the needs of women and working families is a trillion-dollar opportunity, with major secular tailwinds. Areas like flexible and remote work, caregiving and care infrastructure, women’s health, and household financial wellness and productivity have historically been viewed as “women’s issues.” Nice to have; not need to have. Springbank believes these are, in fact, “everyone issues” at the heart of a functioning society, labor market, and the economy at large.

Springbank’s investment thesis can be broken out into the three thematic categories of Care, Career and Consumer. Springbank invests in founders of all genders and backgrounds who are building the tools, products and services that define the new care economy, the future of inclusive work and the next wave of financial progress.

Care

Under their Care theme, Springbank is looking for innovative solutions for children, elders, and women’s health. Solutions include health services increasing quality and accessibility for women and families, tech for aging in place and healthcare at home, professional development for high-growth caregiving careers and/or tools to expand access to and efficient delivery of vetted, quality childcare and early childhood enrichment.

Existing investments include companies such as Wellthy and Little Otter.

Wellthy provides concierge care coordination service for the non-clinical elements of care for families with complex needs. Wellthy is sold through employers as an employee benefit and the company already has over 100 large enterprise clients including Google, Facebook, Best Buy, Cisco, Oracle, Accenture, Delta, Merck and more. They raised $77 million to date

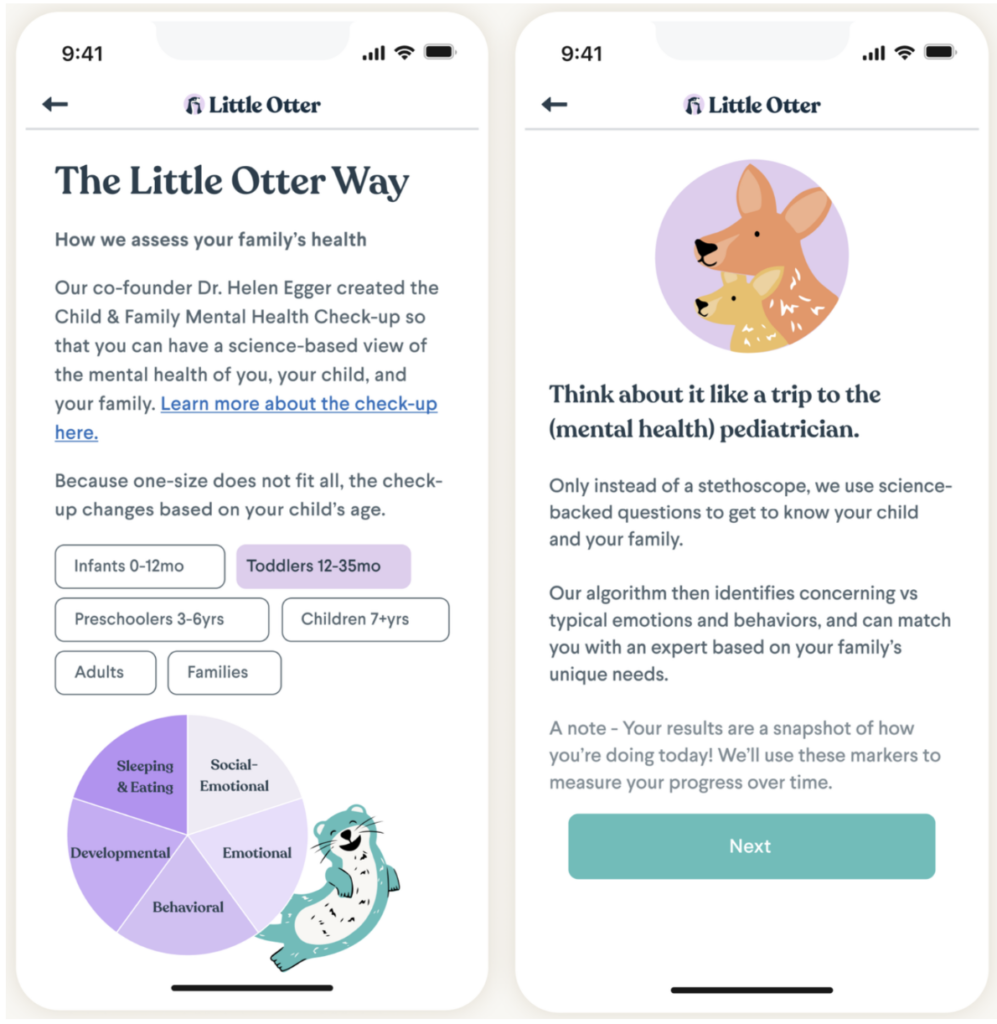

Little Otter is a personalized mental health app for families and children 0-14, designed by the world experts in childhood mental health and delivered fully virtually through a state-of-the-art platform. So far, 95% of families using Little Otter saw clinical improvement after 12 weeks of treatment. Little Otter has grown 45% MoM, and they’ve won numerous award wins and accolades this year.

Career

Springbank’s career vertical focuses on reforming and re-imagining work to enable fair, flexible, dignified careers, increasing women’s workforce participation and improving the quality of jobs in industries where women predominate. Examples of solutions include services that enable flexible, family-friendly, or remote work, Enterprise tools for shift and hourly workers or HR tech that enables inclusive hiring and retention of women and caregivers.

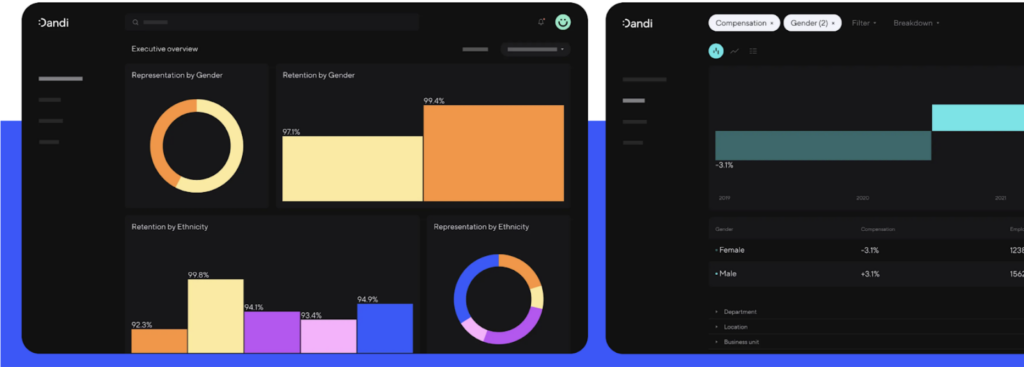

An example of portfolio investment is Dandi has a people analytics platform that gives organizations deep insight into things like compensation, promotion, retention and hiring pipeline by demographic marker enabling them to track their DEI Programs. With a number of US states and Western European countries requiring gender compensation gap reporting, Dandi is the turnkey solution to be compliant with those requirements. Dandi is already serving more than 500,000 employees worldwide.

Consumer

And third, Springbank’s consumer theme encompasses families’ financial health, wellness, and productivity. Solutions include financial services, insurance, and education solutions for women and families, services that reduce friction, making homelife more efficient, healthy, and sustainable and innovative products that recognize women as the chief buyers in the home and build according to their values and needs.

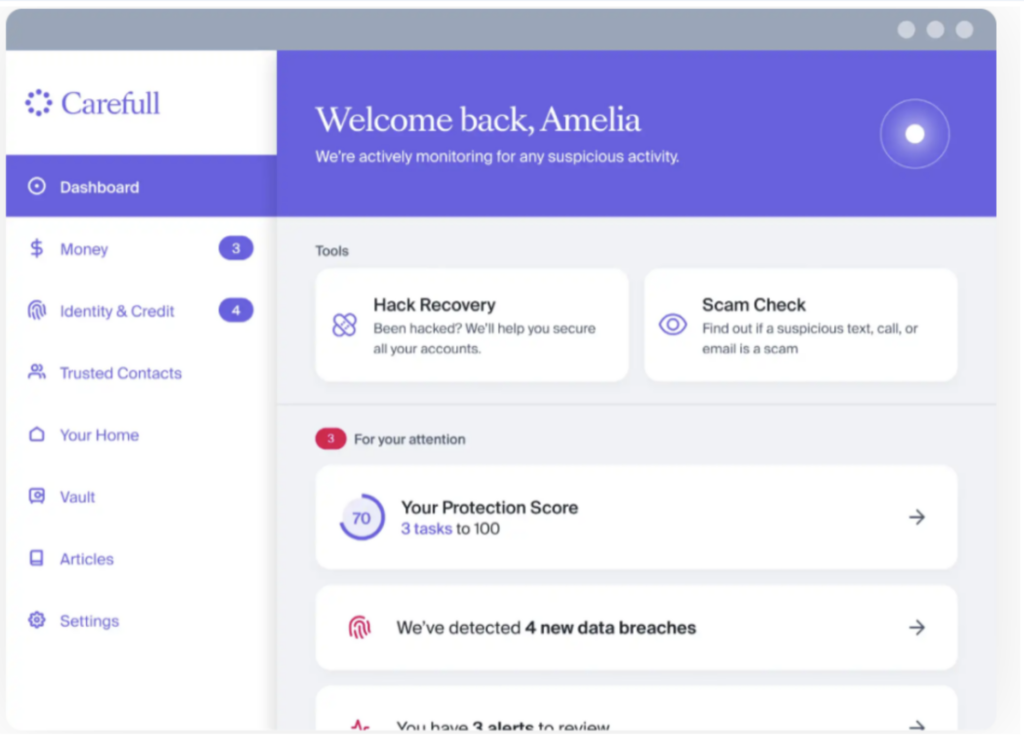

Notable existing investments from Springbank include Copper, a teen banking app that puts financial literacy first and Carefull, a financial tool for families that allows adult children to monitor, engage, and help manage the financial accounts of aging loved ones.

Copper has 2M members and as a value-add investor, Springbank is helping the company with specific strategies to continue to reach girls.

Carefull has over 35 customer institutions and partners so far. The company announced $16.5M funding round in October, led by Fin Capital.

Investments from Toniic members

Gender and racial equity are two of the impact themes generating the most interest within the Toniic community.

Toniic member Ann Morris became aware of Springbank’s capital raise through Toniic’s Investment Programs. After some due diligence with her financial advisor, Ann made an investment in Springbank and shared the below

“My impact investing strategy focuses on racial justice and gender equity. Springbank is a perfect fit for the second strategy. I was impressed with its leadership and am excited to invest in businesses that address systemic problems for women.”

Ann Morris

She joined a list of LPs, including Union Square Ventures, Foundry Group, Bank of America, American International Group, New Summit Investments (another Toniic member!) and JPMorgan Chase in Springbank’s $40 Million final close in June.

About Toniic:

Toniic is a global community of private asset owners seeking to steward wealth and use influence to enable a thriving world. Our members – more than 500 high net-wealth individuals, family offices and foundations from more than 25 countries – are active impact investors and philanthropists, for whom Toniic provides education, investment opportunities, impact support, events, and community. Toniic also seeks to build the field of deep impact investing, moving money and mindsets and leading by example.

Click here to learn more about Toniic

Or

contact Julien Gafarou, Director of Investment Research if you’d like to learn more about the Toniic membership or to share an investment opportunity.