In Africa, Small-and-medium sized enterprises (SMEs) contribute to an estimated 80% of total employment. SMEs are the backbone of economic growth on the continent. Sub-Saharan Africa has an estimated 44 million formal MSMEs (Micro, Small and Medium Sized enterprises). More than half of these vital businesses lack access to affordable financing solutions.

In 2018, the IFC estimated that the finance gap for SMEs in Africa to reach $331 billion. Across developing countries globally, a 2017 World Bank study estimated the SME financing gap to be $5.2 Trillion.

Africa is currently undergoing a Digital Revolution, with Venture Capital funding growing from $350M in 2015 to $3.5B in 2023, with a high of $6.5B in 2022 before the recent market downturn resulted in 46% decline, according to Partech’s latest Africa Tech Venture report. Venture capital works well with asset-light, hyper-growth businesses, but it doesn’t fit the needs of most businesses and especially SMEs, which are often asset- / equipment-heavy and don’t have the same 100x growth potential.

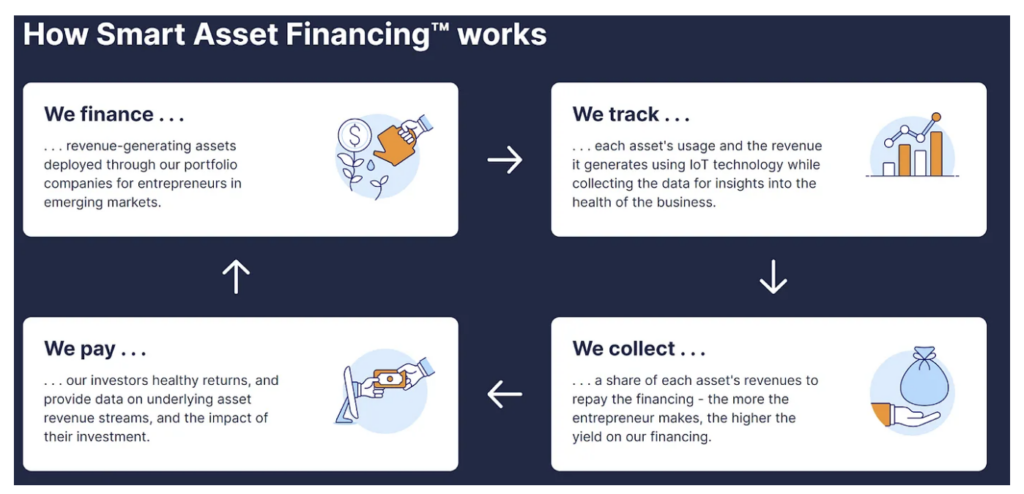

Founded in 2021, Untapped Global has developed an investment platform and capital facility for Smart Asset Financing™ to help solve this massive problem. Untapped provides revenue-based financing to businesses by leveraging connected assets. Its data platform digitally tracks and collects repayments from productive assets used by micro-entrepreneurs and small businesses in emerging markets. The aim is twofold: to boost incomes and build community wealth, as well as to raise awareness about the financial and environmental advantages of adopting climate-friendly technologies.

Untapped finances top Operating Partners, or local companies, who are experts at deploying the assets and managing the entrepreneurs across multiple asset types, industries, geographies, and currencies. Untapped’s data integration systems with each Operating Partner enable them to track the usage and revenue streams and assess the health and scalability of the business in real-time.

The model allows Untapped to offer an alternative source of capital to entrepreneurs whose CAPEX-heavy businesses don’t fit the conventional mold of VC and who don’t have access to traditional loans or grants, while giving investors the opportunity to invest directly in life-changing, economy-boosting innovations, and still earn a strong return.

Since 2021, Untapped has captured over 4.5 million data points in real-time from over 19,000 assets, providing Smart Asset Financing™ to 52 companies across 15 countries.

Assets range from motorcycle taxis and vehicles for last-mile delivery to clean water dispensers and diagnostic medical devices. Countries include Uganda, South Africa, Nigeria, Rwanda, Benin, Togo, Kenya, Ghana, Zambia, Côte d’Ivoire, and Mexico.

Untapped in numbers – since inception in 2021 through December 2023:

- $11.4M Capital deployed

- $7.93M Revenue collected

- 19,296 Assets financed (up 43% from 2022)

- 22.74% IRR on capital deployed

- 100% repayment rate to note holders

Portfolio Examples

Koolboks is a clean-tech company providing “cooling-as-a-service” to small business owners, particularly women in the informal sector, in off-grid and weak grid areas in Nigeria and across Africa. Untapped finances Koolboks’ solar freezers up front, allowing them to lease thousands of them to small-scale women entrepreneurs in Nigeria, lowering the overall cost of acquisition and providing revenue-generating assets that create value for the local economy and access to capital.

OX Delivers provides electric trucks built for rural areas in developing countries and offer on-demand logistics services for remote businesses in Rwanda. These vehicles, combined with a digital platform designed to work even on 2G feature phones, provide transport solutions for smallholder farmers and small-scale traders who otherwise struggle to get their goods to market. Untapped has partnered with OX Delivers to finance electric trucks to add to their Rwanda fleet and OX Delivers’ use of data to make strategic and operational decisions strongly aligns with Untapped’s model.

Toniic’s fund program

Toniic runs a fund program enabling fund managers to share details of their capital raises with the 500+ investors of the Toniic community. A large number of funds are sourced from within the Toniic community, as existing investors who are members of Toniic are often keen to share impact opportunities with their Toniic members.

Four Toniic members were previous investors in Untapped Impact Notes, including Sayuri Sharper who made the introduction to the Untapped team.

“I’ve been an investor of Untapped since the inception of the fund, and am very satisfied with both its impact and financial return. Untapped is the first fund that I am aware of that uses a revenue share model for asset backed financing to facilitate scaling of African businesses. What impresses me most about Untapped is its commitment to total transparency. Investors can track performance of each of Untapped loans and resulting impact through the investor portal and have full visibility to its operation”

Sayuri Sharper:

Toniic member Ed Brakeman also said:

“Untapped is meeting an important need in providing funding for African SMEs that are seeking growth capital to support capital expenditures in productive assets. Untapped is approaching this in a unique way that is well-aligned with their partners objectives.

Through Toniic’s fund program, which includes onboarding the fund on our global platform, an investor matching service, an internal investor call and some group investor calls, Toniic member Donald Dolifka was able to learn about the opportunity, ask questions.

Donald is the latest Toniic member to commit to Untapped.

Donald Dolifka:

Untapped Global has created a unique lending program to help address the massive SME funding gap in Africa. The company combines cutting-edge digital technology along with strong field building systems to properly source and de-risk asset-backed financing programs. Their unique revenue sharing structure provides debt repayment stability for the borrower while delivering market rate returns to investors. I’m particularly impressed with Jim Chu’s mission to empower small business in Africa, while utilizing his experience and leadership to build the supporting technology and people systems.

About Toniic:

Toniic is a global community of private asset owners seeking to steward wealth and use influence to enable a thriving world. Our members – more than 500 high net-wealth individuals, family offices and foundations from more than 25 countries – are active impact investors and philanthropists, for whom Toniic provides education, investment opportunities, impact support, events, and community. Toniic also seeks to build the field of deep impact investing, moving money and mindsets and leading by example.

Click here to learn more about Toniic.

Or contact Julien Gafarou, Director of Investment Research if you’d like to learn more about the Toniic membership or to share an investment opportunity