1.5 °C (or 2.75°F) above pre-industrial levels is the warming limit that would significantly reduce the risks and impacts of climate change, as recognized by world leaders in the Paris Agreement.

If RESIN8™ were to replace just 2.8% of the natural aggregate used in concrete globally each year, this would be enough to absorb all the plastic waste on Earth.

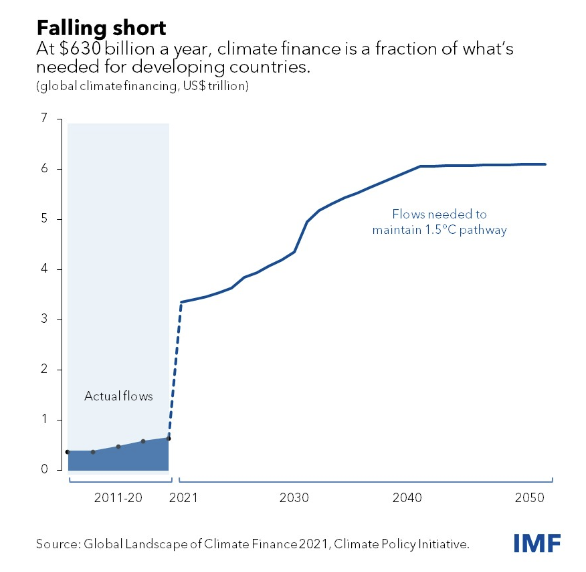

Early-stage climate tech venture capital is underfunded relative to later categories and the need to “kindle” startups for later-stage capital to scale.

Some asset owners looking to deploy capital for climate impact find the asset class intimidating.

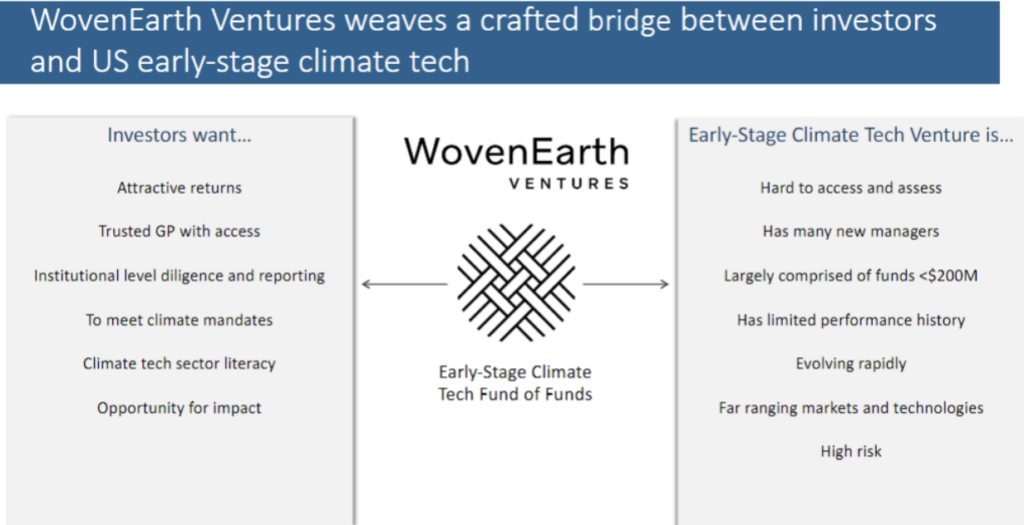

WovenEarth Ventures seeks to answer the urgent call of climate investing with a carefully curated fund of funds, providing its Limited Partners (LPs) with highly diversified exposure to early-stage climate tech venture funds.

The $150M fund will build a portfolio of 25+ funds for 14 managers, giving an exposure of over 300 underlying portfolio companies with products and services to enable significant GHG reduction and improve sustainability.

Additional benefits for Limited Partners include regular workshops that socialize portfolio fund managers and take a deep dive on specific decarbonization themes.

WovenEarth’s all-women leadership team includes Jane Woodward, a 35+ year energy investor and Stanford educator; Mauricia Geissler, a seasoned CIO with over 35 years of investment experience; and Denise Miller, an energy transition strategist with investment experience with utilities and oil and gas.

WovenEarth categorizes climate tech companies across 7 verticals…

- Energy

- Food, Land and Water Use

- Transportation

- Built Environment

- Carbon Removal & Management

- Climate Intelligence

- Industry & Supply Chain

…and tracks impact across 4 categories

- Mitigation – Avoiding carbon emissions

- Sequestration – Removing carbon from the atmosphere)

- Adaptation – Increasing resilience to climate change

- Resource management – Improving sustainability of finite resources

The fund includes four types of managers: Generalists, Thematic / Specialist, Digital, and Niche Project Development.

To date, WovenEarth has committed millions to 12 managers in 23 funds with exposure to over 230 companies including 23 co-investments.

Some of the managers backed by the fund-of-funds include: Anthropocene Ventures (Generalist), Earshot Ventures (Generalist), LowerCarbon Capital (Generalist, founded by Chris Sacca), Volo Earth Ventures (Generalist), Voyager Ventures (Generalist), Burnt Island Ventures (focused on Water Tech), Trailhead Capital (focused on Regenerative Agriculture), Buoyant Ventures (Digital).

Two Toniic members invested in WovenEarth Ventures, praising Jane Woodward’s credentials, track record, network, rigor at doing due diligence and ability to provide useful counsel.

One Toniic member was an investor in Woven Earth prior to the fund’s participation in Toniic Investment program and was available as an LP reference check for prospective investors, including Martha D. who ended up committing to the fund.

Toniic member Martha D. said:

“Reviewing the pitch deck, I realized I had connections to Jane Woodward through Stanford and RMI friends and another investor of the Toniic community gave a very positive review of Jane’s earlier funds.

- I decided to invest because

- I had a high comfort level with CEO through calls and an in person meeting

- It is a fund of funds and so spreads out the risk

- I wanted to place direct investment in cleantech energy without having to decide on individual investments. Through her Stanford teaching job in the Civil and Environmental Engineering Dept, Jane has contacts with many cleantech startups.

- I appreciate the quarterly educational workshops on types of energy (solar, battery, fusion, etc.) and annual reports.

Despite personal links, I would never have heard about the investment without Toniic’ s Programming.”

About Toniic:

Toniic is a global community of asset owners seeking deeper positive net impact across the spectrum of capital. Our members consist of around 500 high-net wealth individuals, family office, and foundation asset owners who are deepening their impact across the spectrum of capital and personal resources in more than 25 countries around the world.Click here to learn more about Toniic

Or

contact Julien Gafarou, Director of Investment Research if you’d like to learn more about the Toniic membership or to share an investment opportunity.